Returns are our mission.

Lamplighter developed its investment program based on sound fundamental analysis.

But that’s not the only piece of the puzzle.

We use a toolbox of techniques against a constantly changing investment opportunity set.

Hard

Choices

Investing is hard. So is not investing. Here's a picture of what happened to your money by not investing in the US over the past 20 years. You would have lost 97% relative to the market. Ouch.

If you had invested, you would have 13 times the money you began with. So playing the investing game to begin with, the odds are probably in your favor. That must feel great, right?

There's a lot that first picture leaves out. Here’s another picture — an EKG measuring the heart rate of an investor over that same time. The peaks show investor stress.

It’s not a real EKG. This picture just shows how often you’d be more than five percent off your high. That’s most of the time. But it does a decent job of showing how much time you spend feeling angst about your investment.

All sorts of pitfalls threaten to derail that long term path to success. Lamplighter keeps your money on track.

Play the Right Games

Imagine walking through a carnival arcade. You pass all sorts of different booths with different games. The ones you notice first are the big flashy ones. But there are others too. In one booth, all you have to do is walk through and pick up money. The cost to play this game is less that a dollar.

These types of games exist in financial markets too. They are the ones Lamplighter looks for. Often just looking at things outside the main indices is enough to uncover attractive investments. Sifting through certain situations like mergers, companies breaking up.

There are lots of investing arenas to pick from. Lamplighter chooses the ones with the best odds of success.

Don’t Panic

Investors are a nervy bunch. They tend to fret about, well, everything. And not without reason. Since 1990. The S&P 500 has fallen 20% from its previous high in five spells. That’s once every six years. Sometimes it goes longer, sometimes shorter, but investors often worry about the next bubble popping.

Should they? If you were the unluckiest investor and only put money in stocks on the highest day for the markets each year for the past 35 years you’d have made about 4 times the amount you invested.

Compared to not investing, that’s pretty good. Compared to the 5 times return you would have made if you were lucky and only invested on whatever day each year the markets were lowest, that’s still pretty good.

These first two pillars of Lamplighter’s investment program — playing the right games and taking advantage of other’s poor choices — are a return on the scarcest input, time. Lamplighter doesn’t need to evaluate every opportunity in the marketplace to find attractive ones. The final pillar of the firm’s effort deals with the nuts and bolts of investment analysis.

There are two lessons from investors feelings. First, don’t panic. Second, once you master your own behavior, look for opportunities in the bad behavior of other investors.

Back to Basics

How much might you get back making an investment? If the money comes in, when will you get it? What’s the chance you don’t get it back?

Every bit of research, every financial measurement, every bit of evaluation about an investment goes to answering these questions.

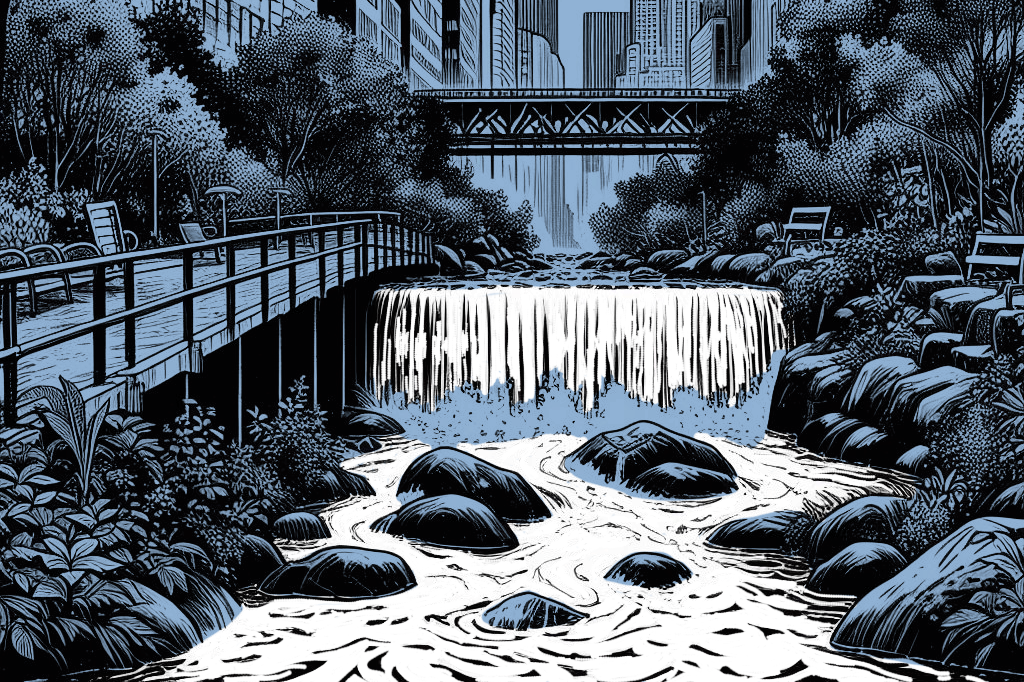

Some investment returns trickle in steadily. Some come in torrents or all at once. Some don’t come back at all.

Invest in companies that will make money. Don’t pay too much. Be patient.

That simple framework in concert with good behavior and picking the right games makes the portfolio sing. That simple framework leads down many more subtle avenues, but it all begins there.